Using a Budget to get out of Debt

Since posting What does debt have to do with it? I've gotten a lot of questions on how we were able to pay off $16,094 worth of debt in six months. The short answer: a lot of long hours, cheap dates, and no vacations or splurge spending. The long answer: we budget every week, use cash, cut expenses, and find ways to save on EVERYTHING.

We budget off of an irregular income because Zac's hours are not set and he has multiple employers. Therefore, we budget on a weekly basis. This works well for us because we get paid on opposite weeks, if you are a two income household and you get paid on the same week, you might want to consider a bi-weekly budget.

I had attempted a budget prior to completing Financial Peace University, but I had never completed a zero-based budget. For those of you who know us, you might be wondering why on earth I would do the budget considering my lack of mathematical skills. You are correct, except that I am the detail person and even Zac will admit that if you're a skilled mathematician with no attention to detail, a weekly budget means there will be no budget. Even Dave Ramsey will tell you it takes at least 90 days to get the hang of a zero-based budget, so a couple overdraft fees may happen, it's a learning process.

A zero-based budget means every dollar has a home…and home does not mean in the checking account to be absorbed by the debit card when you feel like Chinese takeout. Each week the amount of incoming money gets entered in the budget. Below that line I have a list of all the expenses coming out that week. Here's a typical week for us:

We believe in automating the important, so all nonnegotiable items come out of our account automatically. All of the above items are coming out of the checking account automatically on the shown week. Next we subtract the amount going out automatically from the amount that came in and the remainder gets taken out in cash and distributed to our envelope system. (Note: we do leave a $100 buffer in the checking account at all times.)

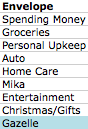

The envelope system works like this. Each week, the cash that is taken out of the checking account is distributed in the following order. The envelopes are funded in order of priority; if the money runs out before all the envelopes are funded, the remaining categories don't get any money. Here are the items we fund with cash:

Spending money is the $20 a week that we pay ourselves to do whatever we want with (Caribou, Subway, Chinese takeout, etc) and the rule is that we don't ask each other where the other person's spending money went, it went wherever they wanted it to go. There have been weeks where we've had to sacrifice spending money for groceries, but for the most part it has worked well for us. The reason we use cash for groceries is because we inevitably went over budget if we paid with the debit card. EVERY SINGLE TIME. Personal upkeep means haircuts, new clothes, etc. Mika is our dog and we fund her envelope minimally, just enough for monthly grooming, food and treats. Entertainment is for babysitters and date nights, someday I hope to up this fund dramatically but for now it only gets $25 a week. The Christmas/gift fund will start getting a bit more each week now that we are entering the holiday season. Last but not least, Gazelle.

If you're familiar with Financial Peace, you know what Gazelle means: DEBT REDUCTION LIKE YOUR LIFE DEPENDS ON IT. At the end of every week, whatever cash is left after the envelopes are funded goes into Gazelle. All of it. The Gazelle envelope is not the only money going toward the debt, it's just making sure all the extra money isn't going anywhere it shouldn't be. We also make a "minimum" payment to whatever debt we are attacking. Currently we are attacking our last credit card which has a remaining balance of $5,125. The "minimum" on this card is $400/month. Here's how we came up with the payment amount:

Credit Cards 1, 2, 3 and 4 plus the vehicle loan are paid off and their minimums have all rolled into Credit Card 5's minimum, totaling $388 (which we rounded up to $400). The idea behind the debt snowball is this: at some point you were making all of these minimum payments and surviving, so just because they're paid off doesn't mean you should be putting less money toward debt. Once this last credit card is paid off, the monthly payment toward the FedLoan School Loan will be $475/month.

On average, we have set aside an extra $1,500 per month in our gazelle/debt reduction envelope. We also received a tax return which all went toward the debt and if we receive any bonuses from work the full bonus is put toward the debt as well. If you're thinking to yourself, "there is no way we have an extra $1,500 of discretionary income every month," we said the same thing. We had no idea we would be able to find an extra $1,500 a month just by budgeting, but we did.

Budgeting is hard, and you need to have your spouse on board. Implementing a budget without your spouse on board will most definitely result in overdraft fees, bills being paid twice or not at all, and many many conversations that start with "I just don't feel like you're on my side" and end with a large bowl of ice cream. If you ask either Zac or I what the secret to budgeting and paying off debt is, we will tell you wholeheartedly that we have given to God throughout this entire process and we truly believe he is honoring that commitment.

So get on the same team, pray, and stick to it. You'll be amazed at the results. We promise.

"You see that his faith and his actions were working together,

and his faith was made complete by what he did."

James 2:22